Over the course of the last 100 years in our US economic history, there have been a series of booms and busts on record that helps to explain the current state of our economy . A great example of a boom and bust cycle would be the recent housing market debacle. Whether this particular boom and bust was predictable or not remains questionable. There were a few economists and smart investors that knew when to get in and get out because they understood the laws of S curve economics. Every new trend and/or product has a pre-knee stage, beginning stage, critical mass stage and lager or loser stage. There always seems to be the select few that are in the right place at the right time. That is because they have the right information and financial intelligence to prosper within any given trend.

Over the course of the last 100 years in our US economic history, there have been a series of booms and busts on record that helps to explain the current state of our economy . A great example of a boom and bust cycle would be the recent housing market debacle. Whether this particular boom and bust was predictable or not remains questionable. There were a few economists and smart investors that knew when to get in and get out because they understood the laws of S curve economics. Every new trend and/or product has a pre-knee stage, beginning stage, critical mass stage and lager or loser stage. There always seems to be the select few that are in the right place at the right time. That is because they have the right information and financial intelligence to prosper within any given trend. Today, there are a select group of individuals, the 5% ers, that know what and when the next trends will be and how to capitalize on those trends. One of driving forces behind the next trends are based on the baby boomers. The baby boomers, the people born between 1946-1964, have hit an age where they are just starting to retire and will continue to retire in massive waves over the next few years. Just as economists predicted many of the spending cycles and habits based on the baby boomer generation, they are able to predict the future of our economy based on the same data.

In the 1990’s, the baby boomers reached their peak spending years, which helps to explain why the economy was experiencing an upswing. Now, with those same baby boomers on the fast track to retirement, we have only just begun to see a downward spiral in our economy. With approximately 310 million people in the USA, lets take a look at the breakdown:

If we look back to around 1926, approximately 47 million were alive, which ended up producing 78 million people born between 1946-1964. (its around 110 including illegals). The baby boomers only had approximately 57 million children, which subsequently, 20 years later had 50 million children, then 40 million children 20 years after that. There are approximately 18 million children currently under the age of 10. If you do the math, our population has declined dramatically. The decline has and will continue to impact the economy as we move forward.

I know there are a lot of other factors and variables that have contributed to the current state of our economy, (Government spending, etc) but lets focus on some facts about the baby boomers for a minute and see how this will affect us:

Size of the Boomer and Senior Markets:

78 million people were born between 1946 and 1964, which is defined as the baby boomer era (U.S. Census).

110 million baby boomers total if you combine illegals

The first baby boomer turned 60 on January 1, 2006.

An American turns 50 every 7 seconds-that’s more than 12,500 people every day (U.S. Census).

As of 2009, 48 is the largest age group in the United States (U.S. Census).

By 2015, those aged 50 and older will represent 45% of the U.S. population (AARP).

By 2030, the 65-plus population will double to about 71.5 million, and by 2050 will grow to 86.7 million people (U.S. Census).

Wealth of Baby Boomers and Seniors:

78 million Americans who were 50 or older as of 2001 controlled 67% of the country’s wealth, or $28 trillion (U.S. Census and Federal Reserve).

Households headed by someone in the 55-64 age group had a median net worth of $112,048 in 2000-15 times the $7,240 reported for the under 35 age group (U.S. Census and Federal Reserve).

The 50+ have $2.4 trillion in annual income, which accounts for 42% of all after-tax income (U.S. Consumer Expenditure Survey).

Adults 50 and older own 65% of the aggregate net worth of all U.S. households (U.S. Consumer Expenditure Survey).

Spending Habits of Adults 50+:

Adults 50+ account for an estimated $2 trillion in total expenditures for 2005.

This group has $2.3 trillion in disposable income.

Between now and 2010, the total spending for 50+ households will increase by over $900 billion.

By 2010, adults 45-years-old and older will out-spend younger adults by $1 trillion annually.

In 2004, people aged 50 and older spent an average of 47.6 percent of their family’s budget on “nonessentials” (Bureau of Labor).

50% of baby boomers plan to buy a new home after retirement (Del Webb Survey).

As of January 2007, baby boomers are 27% more likely than any other generations to embark on a major home improvement or repair in the next 6 months (Consumer Intentions and Actions Study).

96 percent of baby boomers participate in word-of-mouth or viral marketing by passing product or service information on to friends (ThirdAge and JWT Boom).

Impact on the Economy ( some facts as told by a baby boomer )

We are amused when visitors ask what effect the boomers are having on the economy. Folks, in 2011, the economy IS the boomers! We represent the vast majority of the work force. There are 78 million of us; we ARE the economy. (That is not bragging; that is just a statistical reality.) The huge growth in the economy since the 90s is due, in large part, to 77 million of us working up to our peak earning and spending years.

What are we spending our money on? Other than Metallica CDs and movies aimed at 15 year-olds, whatever is being sold… we are buying it. What kind of cars are we buying? What kind are Detroit and Japan selling? We ARE the upper end of the automobile market. What explains the popularity of SUVs? Mostly, we do. Where do we go on vacation? Everywhere. How do we get there? Every way possible. Day care centers are thriving because boomers do not want to take care of the kids they produced. And their offspring think it is supposed to be that way. (Parents are not supposed to stay home and raise their children. Why, that’s a terribly stupid idea, huh? That is what day care centers and the government is for.)

In the 50s, businesses focused on stuff for kids…. 30 million boomers… and still growing. Gerber (the baby food company) was huge in the 50s. Toys…. there was an enormous growth in the variety and quantity of toys. (“You can tell its Mattel; it’s swell!”) And TV, just coming into its own, focused heavily on kids’ shows. Disneyland…. a 50s thing. (Disneyworld…. a 70s thing, paid more attention to history and thrill rides…. things of interest to young adult boomers.) The stylish cars of the 60s and 70s — a direct response to the boomers.

The huge explosion in recreational vehicles in the 90s…. a direct response to empty-nest boomers.

The first half of the 21st century will see a huge explosion in stuff for aging boomers: active retirement communities and vacation homes, skin creams, tooth whitening goo, cosmetic surgery, lasik surgery, Depends, and, of course, the Hair Club for Men. The biggest expenditures will be in the wellness category.

As (relatively) old and aging as we are, we are still the largest age-related demographic…. “numbers too big to ignore.” Now take these facts and understand that the housing market is dead for a reason and will remain dead for a long time. The economy is in trouble and thatÂ’s not hard to see. With millions of baby boomers retiring, and not enough children growing up to replace them fast enough, the economy will not see the boom that occurred in the 90’s for a long time.

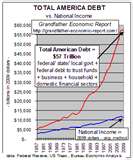

Some final facts and other tidbits of information contributing to our current and future economic crisis.

There are 310 Million Americans

82 Million Working Families

50 Million Americans on Welfare and Rising!

110 Million Working people

61% are living pay check to paycheck

78 Million are Baby Boomers

In less then 16 years they will exit the work force leaving 54 million ppl to replace them and they will pay for it all!

43% of Americans don’t have 10K in retirement

50% of Housing is owned by the banks

21% of Kids live below poverty and that’s increasing daily

62% of America lives paycheck to paycheck

4.28 Million new bankruptcy this year alone

929k new home foreclosures this year or 2900 per day

check out the USDEBTCLOCK.ORG; see for yourself

8.4 Million jobs are now over sea’s with no hope of returning, thousands of jobs leaving every month.

9.6% unemployment #’s will never return to work they had.

Why did I take the time to make note of all this? Gloom and doom? No. With the reality of what is coming and how the Government is handling everything, it is very scary to think about not having a plan B. We are helping America wake up and supply them with truth and wisdom. Every top economist, millionaire and leader we have involved ourselves with, sees the writing on the wall. This is the first time in economic history that a combination of all of these factors are going to hit.

There are always booms and busts and next bubble to burst is going to affect everyone, especially the hard working middle class citizens. We are in the eye of the storm. The good news is, there are always opportunities in a downturn and as we get educated, get better at who we are and leverage the information we receive from those who know what is coming, we can survive and thrive in the next several years. It is all about information. It is about embracing change. It is about understanding that we must dig our well before the well runs dry. There are no guarantees in life but its best to be prepared for a rainy day. It always rains. Its best to have a good umbrella!